Get started in a few clicks

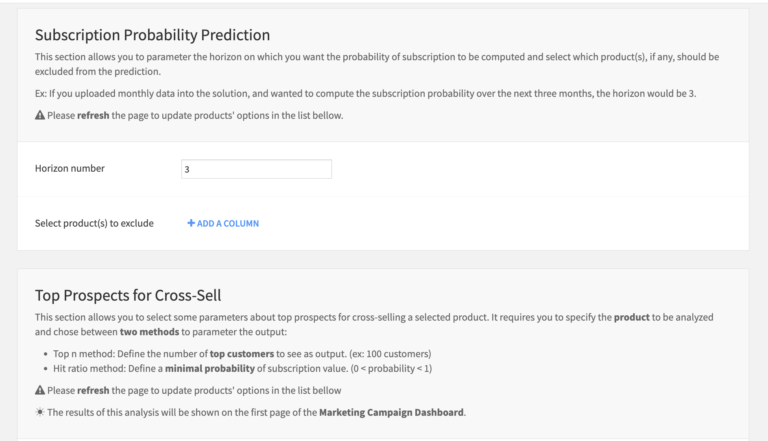

Use the step-by-step Application to quickly load your customer product data and customer data, easily set analytic parameters, and generate immediate and actionable results.

Explore !The goal of this plug-and-play solution is to enable marketing teams to understand how Dataiku can be used to achieve customer-centric marketing leveraging predictive capabilities to provide the best next product offer for a specific customer within a robust and full-featured data science platform, while easily incorporating machine learning and advanced analytics to get the best insights to understand the customers. More details on the specifics of the solution can be found on the knowledge base. This solution is available on installed instances and Dataiku Cloud.

Consumer banking faces myriad marketing and product challenges, including increasing competition, growing customer experience expectations, and increasingly targeted and personalized offers. Traditional mass marketing and email campaigns have been challenged by targeted, tracked, conversion-modeled approaches. And banks are lagging behind: today only 30% of banking customers report feeling they receive personalized banking products and services*.

Next Best Offer (NBO) models use machine learning to analyze customer data and product mix to recommend products statistically more likely to see uptake. Beyond increasing customer experience, NBO is a key step towards improving marketing spend efficiency as well as advisory impact. With NBO, banks change focus from a product-centric to customer-centric view, reduce reliance on costly large-scale outbound campaigns and ensure each customer interaction is of higher-quality and relevance*.

The Dataiku Next Best Offer for Banking Solution allows banks marketing analytics teams to take a jumpstart towards enhanced customer management. Thanks to its plug-and-play structure, they can quickly develop and scale impactful NBO approaches prior to multiplying gains by delivering lead scoring, smart segmentation, customer lifetime value and more using the combined capabilities of Dataiku’s platform and solutions.

* Deloitte, The future of retail banking: The hyper-personalisation imperative, 2020

Use the step-by-step Application to quickly load your customer product data and customer data, easily set analytic parameters, and generate immediate and actionable results.

Explore !

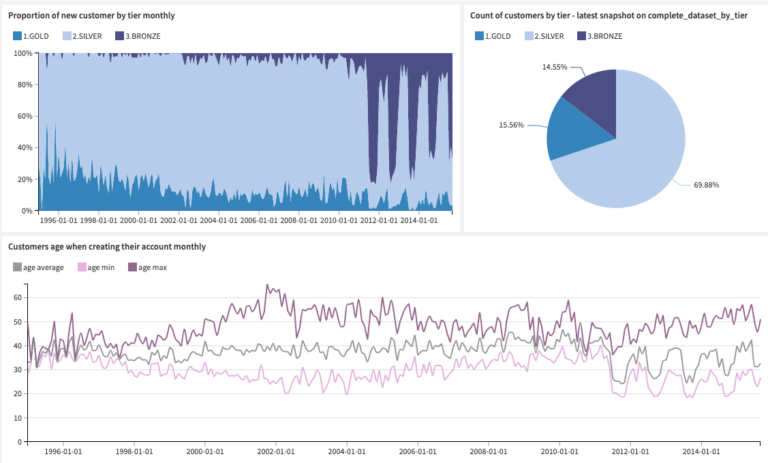

Understand the demographic and product mix disposition of your complete product portfolio, split by segment and vintage.

Explore !

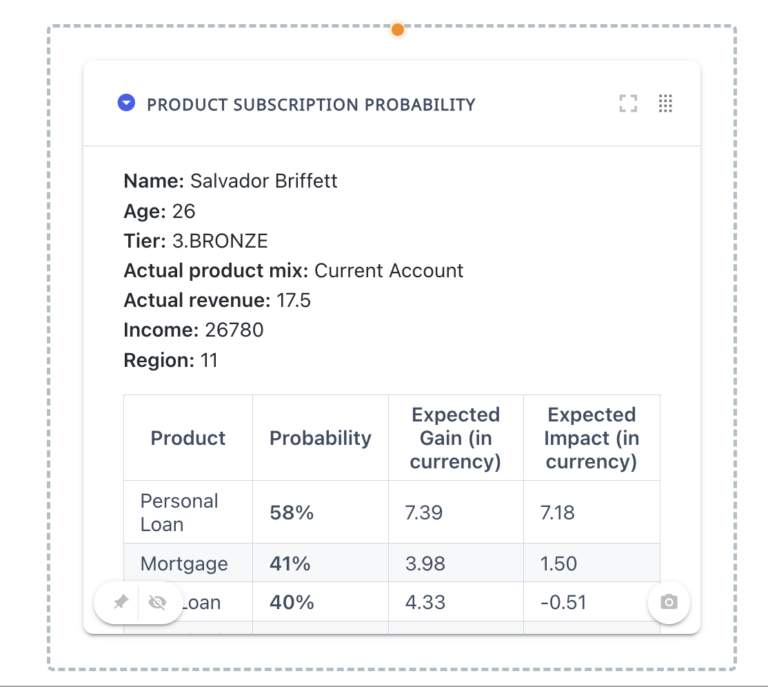

Easily understand the probabilities of cross-sell for each product at the individual customer level alongside powerful estimates of potential revenue gain, allowing precise and efficient allocation of marketing spend. Retrieve connection settings and use the customer dataset containing the results of the segmentation as an input.

Explore !

Create high value lists of top prospects for cross-sell per product, measuring probability to purchase and expected revenue gain from direct and indirect cross-sell, for precision marketing return on investment.

Explore !

Easily embed recommendations into CRMs and other business applications through Advisor.

Explore !

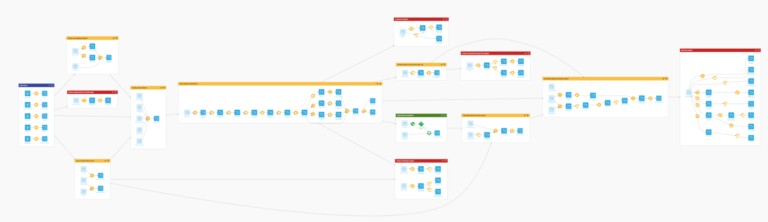

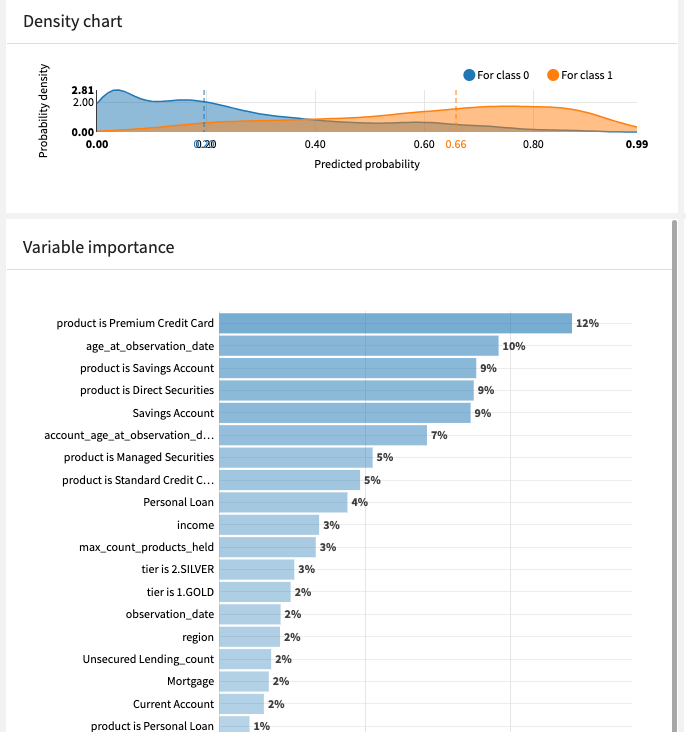

Extensive documentation, fully open code, coupled with in-built diagnostic tools allow the user to have full confidence in each step of the process.

Explore !

Appropriately govern and analyze your model for fairness, compliance, and effectiveness over time.

Explore !