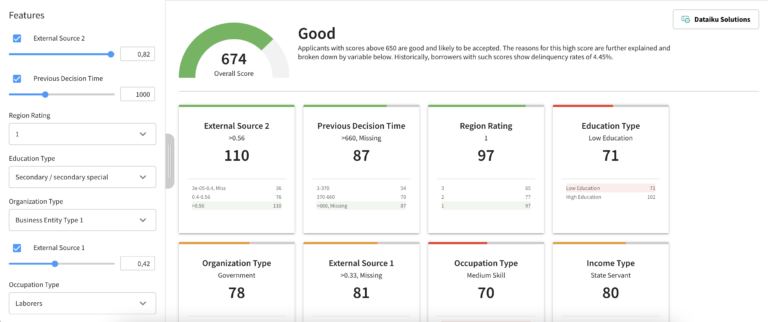

Interactive credit scorecard

Easily understand the drivers of your credit scorecard, and evaluate in real-time the impact of changes to features on the credit score using an entirely visual interface.

Explore !The goal of this adapt and apply solution is to enable Credit Risk Analysts to understand how Dataiku can be used to create a credit-worthiness model to build scorecards in a user-friendly and customizable way. More details on the specifics of the solution can be found in the knowledge base. This Solution is only available on installed instances.

Credit decision making is the cornerstone of successful lending operations, and continuously evolves with customer behavior and data availability. The complexity and depth of analysis required to offer competitive pricing and accurate prediction of credit events is ever increasing. Higher performance models demonstrably increase revenue (5-15%), reduce credit loss (20-40%), and improve efficiency(20-40%)*.

Credit scorecards are a foundational part of a credit teams’ workflow, and enhancing them with more powerful data sources and faster collaborative review is vital to retaining and expanding a customer base. Existing tools can be difficult to adapt to this new environment, and future-focused approaches can often be disconnected from the current technology and needs of the team, siloing the potential benefits and preventing them from being effectively integrated into the working model that directly impacts customers.

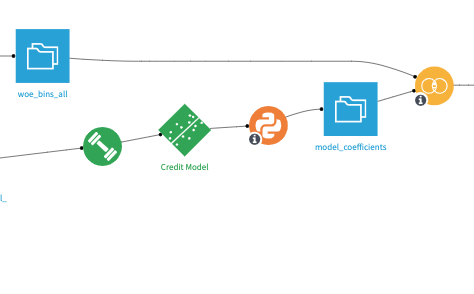

By leveraging Dataiku’s unified space where existing business knowledge, machine-assisted analytics (for example, automatic searching of a large number of features and feature iterations for credit signals), and real-time collaboration on credit scorecards are unified, credit teams can immediately benefit from the value of an ML-assisted approach, establish a foundation on which to build dedicated AI credit scoring models, all while remains connected to their current customer base and systems.

Easily understand the drivers of your credit scorecard, and evaluate in real-time the impact of changes to features on the credit score using an entirely visual interface.

Explore !

API connectors enable even greater flexibility, allowing for real-time connection to models directly by customers or internal teams outside of Dataiku.

Explore !

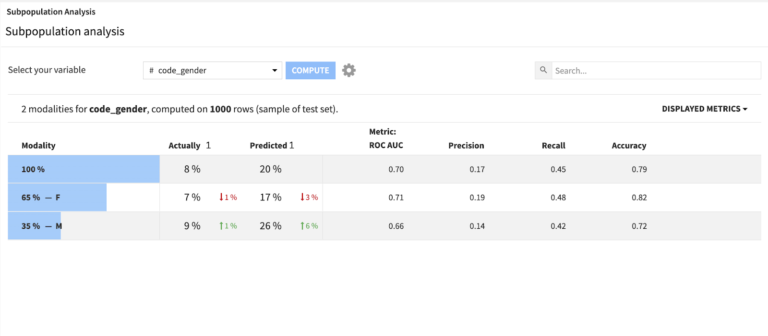

Explore and better understand the fairness impact of the features within your model, supported by easy to understand diagnostics and a Responsible AI (RAI) framework.

Explore !

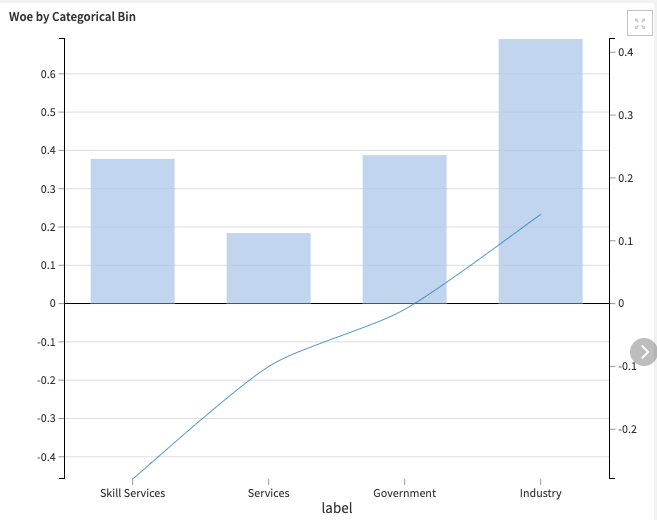

Use integrated weight-of-evidence (WOE) techniques and automatic binning of features to precisely design and improve your credit scoring model.

Explore !

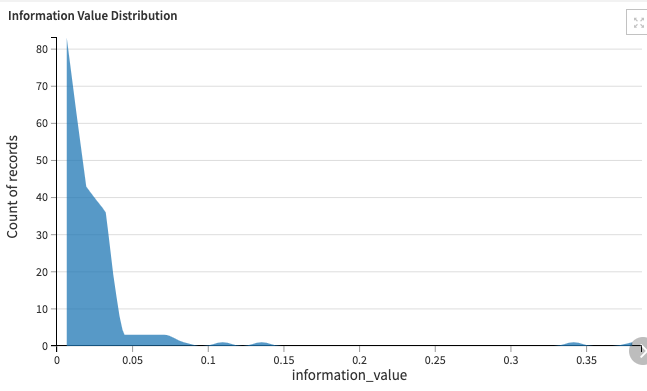

Quickly and easily perform feature selection and interpretation using ML supported techniques alongside intuitive calculations and visualization

Explore !

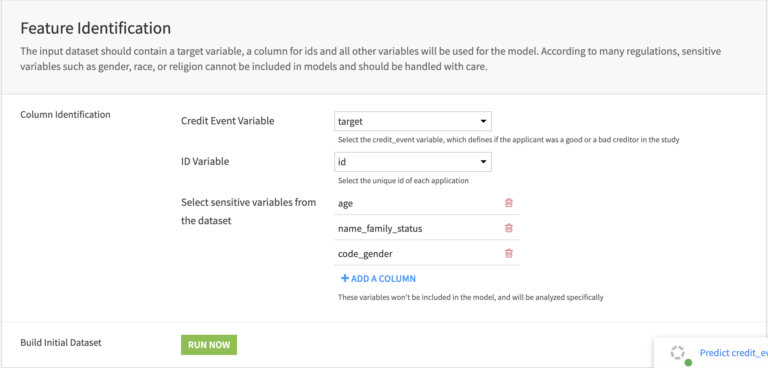

Using the step-by-step Application, load your credit, demographic and external data into Dataiku quickly and easily, decide on key parameters for your scorecard building, and get immediate and actionable results.

Explore !